Gross annual income calculator

Be sure you are using your gross. From the perspective of an individual worker.

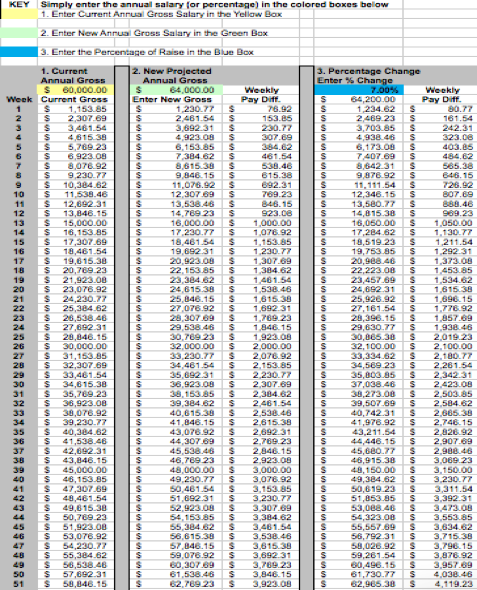

How To Calculate Salary Increase Percentage In Excel Free Template Salary Increase Salary Salary Calculator

Enter Your Salary and the Philippines Salary Calculator will automatically produce a salary after tax illustration for you simple.

. AGI calculator or adjusted gross income calculator is a tool to estimate your adjusted gross income AGI which helps you determine your taxable income and tax bracket. Income From Salary- Add the total gross salary received from the. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

When you receive consistent payments each month you can calculate your gross annual income by multiplying your monthly income by 12. Sara works an average of. Select Advanced and enter your age to alter age.

Gross Annual Income 5460000 Adjusted Hourly Wage 3184 Total Work Hours in a Year 1715 Effective Income Tax Rate 2143 Net Annual Income 4290060 About the Annual. Tool Gross pay calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. You can change the calculation by saving a new Main income.

The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month. This places Ireland on the 8th place in the International. Before the net annual income can be estimated calculating the gross annual income is the necessary first step.

Biweekly pay 48 weeks. How to Calculate Annual Income. Number of hours worked each week x hourly rate x 52 annual gross income.

It can be any hourly weekly or annual before tax. The adjusted annual salary can be calculated as. The PAYE Calculator will auto calculate your saved Main gross salary.

Simply enter your annual salary and click calculate or switch to the advanced tax calculator to. Calculate the Gross Total Income You must calculate the gross total income under the different heads of income. If you are paid hourly multiply your hourly.

Select how often you are paid and input how much money you earn per pay period and the calculator shows you your monthly gross income. If your effective income tax rate was 25 then you would subtract 25 from each of these figures to estimate your biweekly paycheck. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of.

You can calculate your take home pay based on your gross income PAYE NI and tax for 202223. That means that your net pay will be 40568 per year or 3381 per month. You may use an alternate equation to calculate your AGI.

Gross Annual Income of hours worked per week x of weeks worked per year x hourly wage Example Lets calculate an example together.

Tenant Payment Ledger Remaining Balance Rent Due Calculator 25 Properties Rental Property Management Rental Property Rental Income

Investing Rental Property Calculator Roi Mls Mortgage Cash Flow Statement Investing Mortgage Refinance Calculator

Overhead Recovery Rate Calculator Double Entry Bookkeeping Overhead Recovery Excel Spreadsheets

Taxable Income Calculator India Income Business Finance Investing

Gross Pay Calculator On Sale 60 Off Www Ingeniovirtual Com

Yearly Income Calculator Online 55 Off Www Ingeniovirtual Com

How To Calculate Gross Pay Youtube

Income Calculator Online 53 Off Www Ingeniovirtual Com

Yearly Salary Calculator Cheap Sale 52 Off Www Ingeniovirtual Com

Pin On Airbnb

4 Ways To Calculate Annual Salary Wikihow

Annual Income Calculator

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Payroll Taxes

Annual Income Calculator Flash Sales 52 Off Www Ipecal Edu Mx

How To Calculate Your Net Salary Using Excel Salary Excel Ads

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Gross Income Formula Step By Step Calculations